Calculate DEDUCTIONS SAVINGS LOWERED COST with our machinery calculator

Scoop up all the saving before the end of the year!

Offer is valid until 12/31/2023

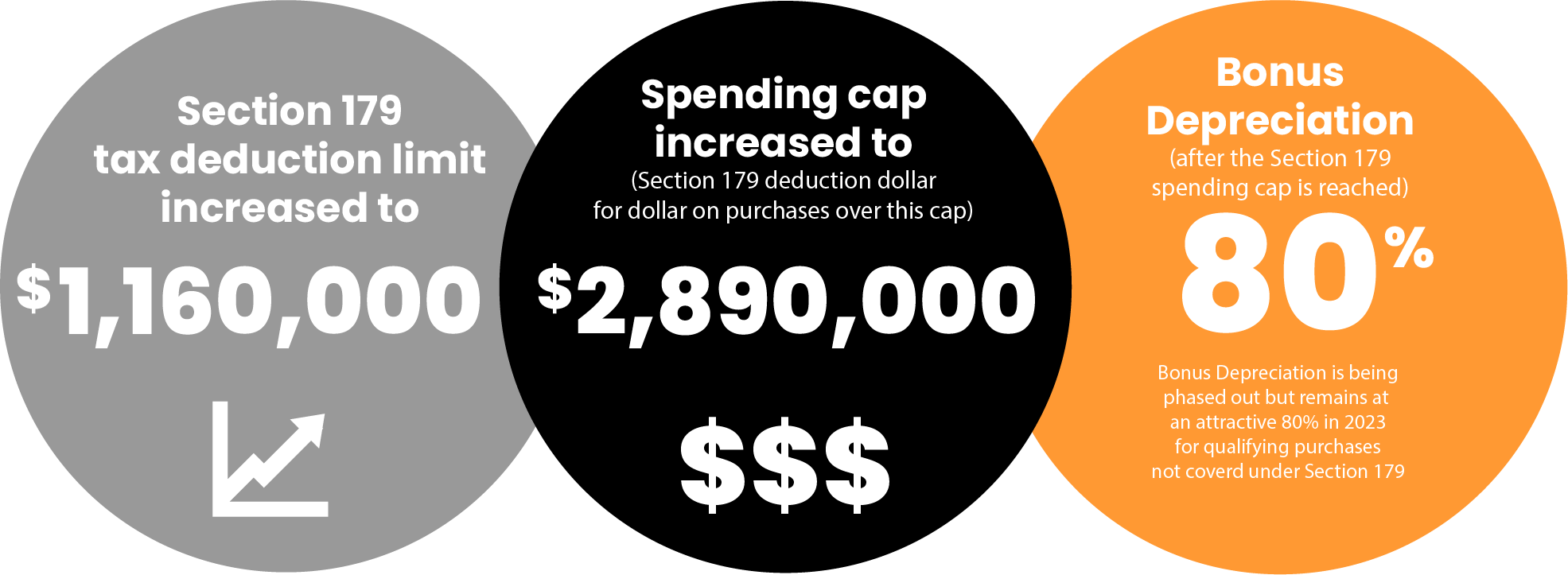

It’s time to get ahead for 2024! 2023 tax savings are here, reduce your taxable income on equipment purchases up to $1,160,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,890,000. The special depreciation allowance is 80% for certain qualified property acquired after September 27, 2017, and placed in service after December 31, 2022, and before January 1, 2024.